Conclusion

One of the first revelations that comes to mind is that the game of money is not really just about money. In the end, it is about your life, and my life. What’s more: you are a part of this game, whether you’d like to play or not. This is because money is a socio-economic construct that has been built by us, human beings, for the purpose of efficient barter. To say that you don’t want any part of it is equivalent to living off the grid (you won’t be reading this article if you’re off the grid anyway).

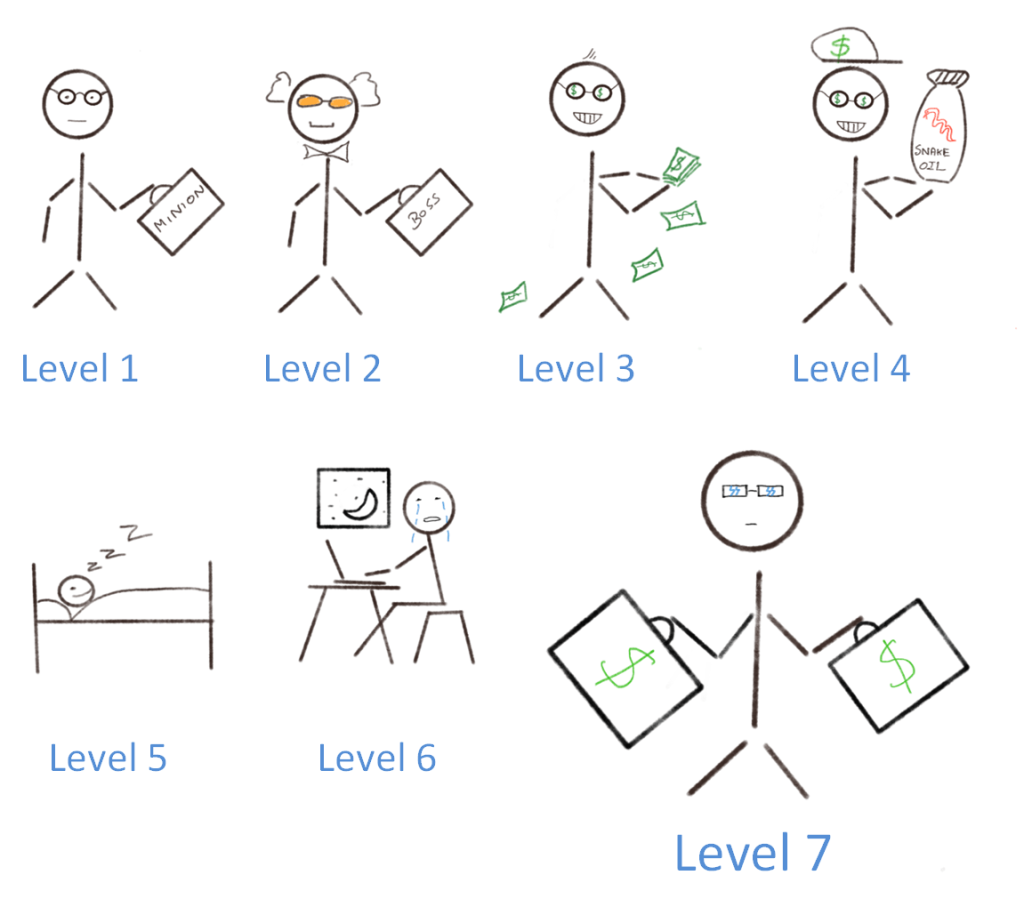

In analysing the different levels that I’ve just presented, I do not try to say that one level is better than the other. Rather, I’m pushing for awareness about these levels in the game of money. Armed with awareness, one can at the very least, avoid pit-falls. From my personal research, and practice, I would say that parallel presence in multiple levels of the game is generally, a fair way to proceed. But it is neither simple, nor is it easy (please don’t shoot the messenger). People are usually limited by their mental accounting (credit: Kahneman and Tversky), where they limit their profits to a mental account, and losses to another separate mental account. Let’s take a young average wage-earner with student debt for instance. He diligently saves money in a savings account. He also services yearly repayments of his student debt. When he thinks about his debt, he gets worried. When he thinks about the fact that he has savings, he is relieved a little. He seldom (statistically, really seldom) looks at these two states together. He creates two separate accounts of his two financial states of debt and savings in order to handle his emotions (this is a psychological phenomenon). But if he were to overcome his accounting heuristic, and look at his entire net-worth as a quantitative sum, he’d be quick to realise that his savings are just damage-limitation, as inflation is eating away his buying power, as he services his debt on a yearly basis. If he projects this scenario, he’d realise how many more years of this miserable net-state would be necessary to truly come out of debt, and consequently change his course of action drastically. This example is precisely the reason why I’ve presented all these concepts as levels in a grand game of money, because people almost never look at all these levels or parallel forms of monetary existence in one grand picture. Looking at the grand picture changes perspectives and actions dramatically. Everybody is hyped-up for ivy-league education, and a consequent well-paying job. When the same ‘everybody’ are told “Don’t put all of your eggs in one basket”, they affirm by saying: “Of course, that’s common sense!” But they still don’t put 2 and 2 together to realise that by paying a fortune for the ivy-league education using borrowed money, and becoming completely dependent on their employer to repay their debt, they are putting all of their eggs in one basket. This doesn’t just apply to the young wage-earner’s example that I’ve chosen. Overcoming the accounting heuristic applies to people of all backgrounds, facing a wide range of financial situations. Therein lies the eye-opener of starting to look at the entire game, and overcome mental accounting to better one’s chances of leading a more meaningful life.

In this context, delegation of authority usually leads to complications. It is usually highly unlikely that someone else has the same amount or more interest in your or your family’s well being, as yourself. If this argument holds, then the question becomes: why would you transfer such an important responsibility to someone else, or worse, neglect it altogether?

It has taken me a considerable amount of time to accumulate, and assimilate this information to the point of presenting it. I hope that you, as the reader, are able to find use in the information from this article, and benefit in life, whilst helping others around you benefit as well.

If you’ve read this far, I humbly thank you for your patience, and diligence, and wish you all the best.

I hope you found this article interesting and useful. If you’d like to get notified when interesting content gets published here, consider subscribing.

Comments